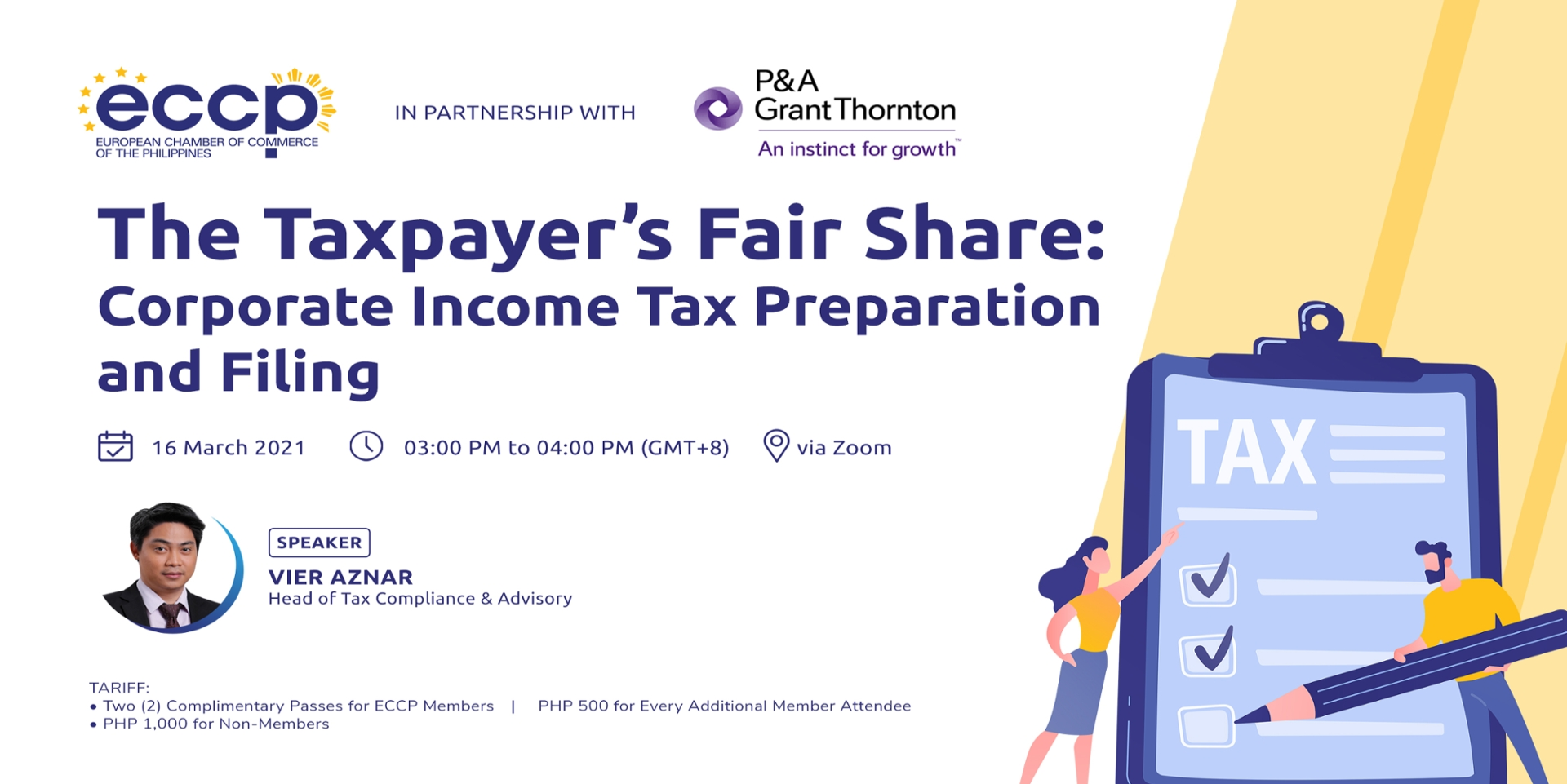

The Taxpayer’s Fair Share: Corporate Income Tax Preparation and Filing

16

March

2021

|

3:00 pm - 4:00 pm

In partnership with P&A Grant Thornton, we will walk you through the basic rules and updates in the preparation and filing of corporate income tax returns.

P&A Grant Thornton's Head of Tax Compliance advisory will cover the following key points in our discussion:

- Basic income recognition rules

- Basic rules and reminders on allowable deductions (cost of sales/services and itemized deductions)

- Computation of taxable income, income tax due and income tax payable

- Compliance requirements (corporate income tax return and required attachments and deadline of filing)